Do You Know All the Facts About Qualified Opportunity Investments?

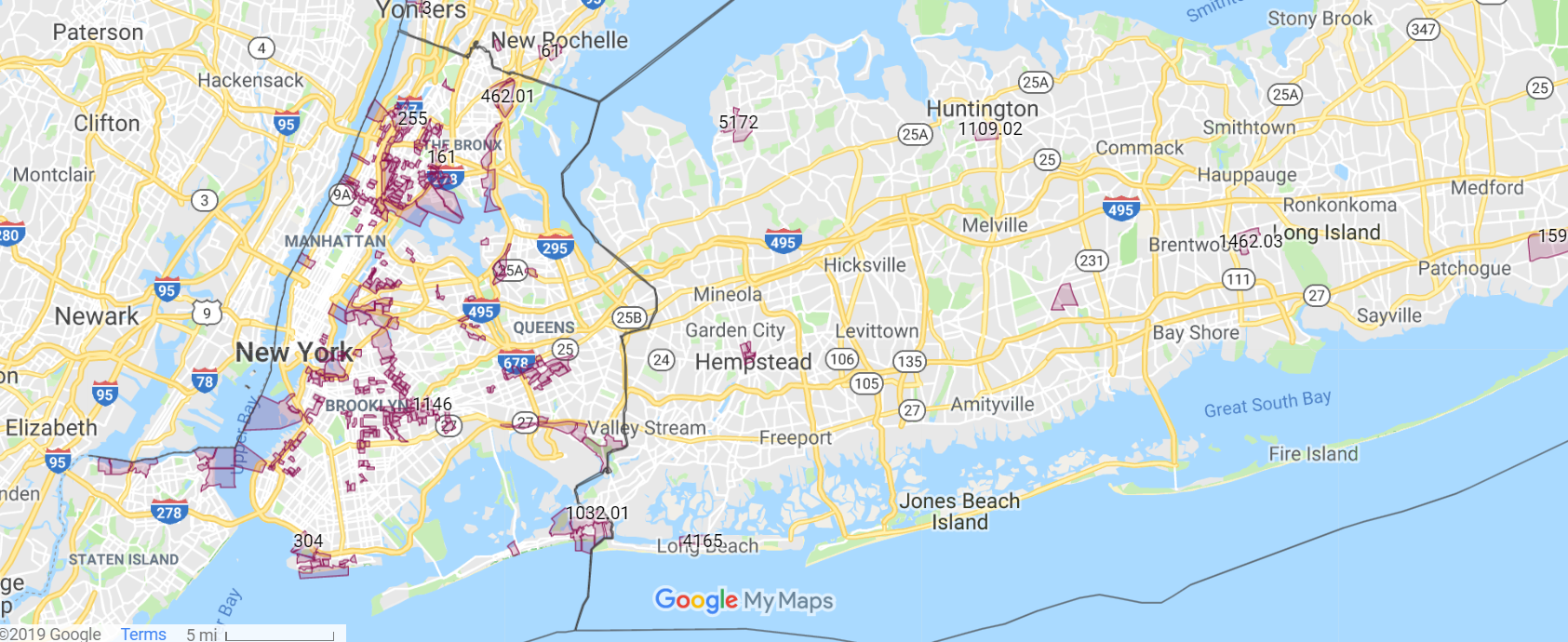

New York, NY, November 8, 2018 – Steven Zelin, CPA of Zelin & Associates CPA LLC is discussing the income tax advantages of Qualified Opportunity Zones (QOZs) and Qualified Opportunity Funds (QOFs) with his clients. “The Tax Cuts and Jobs Act of 2017 created this new tax incentive provision. Each state nominates low income communities in this category for direct resources. A QOF is an investment vehicle that can be organized as a corporation or a partnership holding at least 90% of its assets in QOZs,” explains Zelin. “This is useful for investors who have substantial capital gains and a desire to re-invest them into communities designated for economic development. By investing in a QOZ, investors are able to defer taxes on capital gains, reduce taxes by holding the investment, and eliminate taxes if held for 10 years. In order to receive the full array of QOF benefits, the latest date (according to the current tax code) that gains on the sale of assets can be invested into a QOF is December 31, 2019.”

Zelin points out after-tax gains on this investment can be more than double those of a similar investment because:

- the deferral of capital gains taxes from the sale of appreciated assets until the earlier of December 31, 2026 or the disposition of the qualified opportunity fund,

- the possibility of lowering the capital gains tax up to 15% because of an increase in the basis of the appreciated assets used to buy the fund interest, and

- the possible elimination of capital gains due on the appreciation in a qualified opportunity fund if it is held for 10 years or longer.”

He cautions that QOFs are not for everyone. “Many investors will be better served by using existing strategies, including 1031 exchanges, charitable trusts, and simply holding on to existing assets – all of which may provide tax benefits, including indefinite tax deferral, and the opportunity for a future step-up in basis at death that a QOF does not provide.” One important component to remember is that after making the initial contribution to the fund the investor needs to make a second investment amount of the same amount. Proposed regulations were issued on October 19, 2018.

Mr. Zelin regularly presents workshops on tax and personal finance topics. He has educated the public about the accounting professional through his role as The Singing CPAⓇ, now a registered trademark. His sense of humor shows in his songs: Tax Deductible, Dear IRS, If You Don’t Like Paying Taxes, Audit Client Blues and others featured on his CD, The Singing CPAⓇ introduced in 2008.

His Magical Boxes CD, produced in 2006, presents original and customized songs for children that he presents before non-profit organizations including libraries, schools, camps and corporate events for children. He has also produced other accounting related CDs including No Accounting for the Holidays, a collection of popular holiday songs updated with accounting lore and lyrics including Most Deductible Time of the Year, We Wish You a Great Big Refund, Joy to the World (the Clients Paid) and others.

Mr. Zelin has been an Adjunct Professor of Accounting at Long Island University and Baruch College.

Further information about QOZs, QOFs or the tax advantages of other short or long term investments may obtained by contacting Mr. Zelin at 646-678-4496 or steven.zelin@zelincpa.com

Leave A Comment